Home » 2021 (Page 3)

Yearly Archives: 2021

Building collapses after foundation blunders

A building contractor has been prosecuted after carrying out unsafe excavation works which resulted in the partial collapse of a residential building.

Manchester Crown Court heard how on 14 August 2019, Iproject Cheshire Limited had been carrying out refurbishment works on a building in Didsbury.

Employees of the company undermined the foundations while digging out the ground around the building causing a partial collapse. There were no injuries or fatalities, but the collapse presented a risk to life.

An HSE investigation found that the company failed to properly plan or carry out the work safely. A risk assessment into the excavations had not been carried out. There was no safe system of work in place and the work had not been sufficiently supervised.

Iproject Cheshire Limited of Stockport pleaded guilty to safety breaches and was fined £31,500 and ordered to pay costs of £13,500.

Speaking after the hearing, HSE inspector David Argument said: “This was a very serious incident, and it is fortunate that nobody was injured as a result of it.

“This incident could have been prevented if the company had carried out a suitable and sufficient risk assessment prior to commencing work on the excavations and by properly supervising the work.”

Did you miss our previous article…

https://www.drupalcamppa.org/?p=1701

A Simple Clear Construction Staffing Distress Indicator

>

Well before the pandemic, the construction sector was worrying over what was perceived as an acute shortage of labor. Much of the discussion on this topic over the past several years has been anecdotal. Or reference has been made to employment gains that have been less than they should be and unemployment rates that have sometimes turned spectacularly low.

But it would be better to find some easy-to-understand visual representation of the problem. It’s my hope that Graphs 1 through 5 below, making use of JOLTS data, fit the bill.

From the Job Openings and Labor Turnover Survey (JOLTS), for ‘all jobs’ and 14 major sub-sectors, I’ve taken ‘openings’ levels and ‘hires’ levels and calculated openings-to-hires ratios for every month back to July 2009, which was the first period of recovery after the ‘fiscal crisis’ recession (a.k.a., the Great Recession).

The openings-to-hires ratio essentially captures the degree to which vacant positions are being snapped up (a low ratio) or going begging (a high ratio).

To enable easy comparisons between industries, I’ve indexed their openings-to-hires ratios.

The indexing I’ve adopted takes the July 2009 value for each series and sets it equal to 100.0. (The number could just as easily be set equal to 1.0 but choosing 100 leaves more room for following numbers to move not only up, but also down, should that become the case.)

For each series, the value of each subsequent month is divided by the value in the base month (July 2009) and multiplied by 100.

Since all the series have the same starting value (July 2009 = 100.0), when a couple of them, or several of them, are shown on a graph, their movements over time can be readily compared.

In Graphs 1 through 5, I’ve stuck with only one-on-one comparisons.

The higher the curve, the greater the sought-after employee shortage distress.

From Graph 1, it’s apparent that the increase over time, since July 2009, in the openings-to-hires ratio for construction has far outpaced the increase in the openings-to-hires ratio for ‘all jobs’. (The openings-to-hires ratio will increase in an expanding economy.)

By the way, I must point out that the patterns apparent in Graphs 1 to 5 stay essentially the same even when the base period is shifted (e.g., if January 2015 is chosen = 100.0 rather than July 2009).

In Graphs 2 through 5, the worker shortage in construction is shown to be more severe than in the following: manufacturing; retail trade; transportation, warehousing, and utilities; and accommodation and food services.

As for nine of the other ten industrial sectors not set out graphically below, construction’s labor shortage is far more acute than in any of them except one.

The worst labor shortage in the U.S. is currently being experienced in another goods-producing as opposed to the services-producing corner of the economy, ‘mining and logging’.

![]()

Did you miss our previous article…

https://www.drupalcamppa.org/?p=1697

Birmingham Council cuts KPIs to simplify £2.7bn highways deal

Birmingham City Council has cut hundreds of KPIs during a restructuring of its troubled £2.7bn highways PFI contract.

The tender process for a new contractor for the revamped 12-year deal will start in February.

Birmingham originally signed a 25-year, £2.7bn highways management and maintenance contract back in 2010 with Amey.

But the contractor became embroiled in a lengthy performance dispute with the council which ended in March 2020 with Amey paying £215m to terminate its involvement in the PFI deal.

Kier stepped in as interim contractor while the council and Birmingham Highways Limited – the special purpose vehicle owned by Equitix and PIP Infrastructure Investments – have been working to restructure the contract.

The new contract will cover the remaining 12 years of the initial agreement, from April 2023 to June 2035.

It will be a bespoke deal similar in length to a standard long-term maintenance contract, with operational terms and a performance regime that enables it to be “brought up to date to better reflect current industry standards which have changed over the past decade.”

Birmingham said: “The new contract has been structured to provide better governance of the project and more balanced risk between the Council, the SPV and the future contractor.

“A key element of this is a reduction in key performance indicators from over 600 to around 28 as well as prioritisation of deliverables, addressing both areas which routinely plagued the previous contractor Amey during its tenure as subcontractor.”

Prospective bidders will go through a competitive and transparent tendering process which is due to begin in February 2022, following the supplier day in January.

The process will be conducted over a period of nine months and be structured to provide bidders with sufficient time to undertake due diligence.

During the interim period, an updated Management Information System (MIS) was implemented to collect data from across the road network to provide a greater understanding of current conditions and areas for improvement.

Bidders will be provided with access to this information via a data room, which includes a database of assets and will allow bids to be informed by bidders’ due diligence and analysis.

The data room will include new information about the current status of the road network from improved data collection and analysis, including full network surveys of carriageway conditions that have been undertaken by independent surveyors.

This information will be shared with bidders during the tendering process, providing them with the most detailed understanding of the status of the network to date and provide greater clarity over what can be delivered over the term period.

The contract covers capital works and maintenance of more than 2,500km of roadways and 5,000km of footways across the UK’s largest authority and second largest city, as well as 846 structures, three tunnels, 94,000 street lighting columns, 76,000 highway trees and the city’s traffic control system.

Kevin Hicks, Assistant Director for Highways and Infrastructure of Birmingham City Council, said: “Extensive work has been put in over the last two years by all of the project parties and with the close support of the DfT in order to establish a workable and deliverable contract framework.

“Many lessons have been learned from the first 10 years of the project and with the insight we have gained from the industry through previous engagement exercises believe that we have an attractive prospect for the market.”

Did you miss our previous article…

https://www.drupalcamppa.org/?p=1688

Crackdown on directors who fold firms to rip-off creditors

Rogue bosses who dissolve their companies to rip-off staff, creditors and the taxpayer can now be disqualified from being a director.

The Insolvency Service has been granted new powers to tackle unfit directors who place their firm in administration to avoid paying subcontractors and suppliers.

The new legislation extends the Insolvency Service’s powers to investigate and disqualify company directors who abuse the company dissolution system.

If misconduct is found, directors can face sanctions including being disqualified as a company director for up to 15 years or, in the most serious of cases, prosecution.

The Business Secretary will also be able to apply to the court for an order to require a former director of a dissolved company, who has been disqualified, to pay compensation to creditors that have lost out due to their fraudulent behaviour.

Insolvency Service accountants will also be able to scruntinise live companies where there is evidence of wrongdoing.

The Rating (Coronavirus) and Directors Disqualification (Dissolved Companies) Act will also help tackle directors dissolving companies to avoid repaying Government-backed loans taken out during the Coronavirus pandemic.

Business Secretary Kwasi Kwarteng said: “These new powers will curb those rogue directors who seek to avoid paying back their debts, including government loans provided to support businesses and save jobs.

“Government is committed to tackle those who seek to leave the British taxpayer out of pocket by abusing the covid financial support that has been so vital to businesses.

Stephen Pegge, Managing Director of UK Finance, said: “The ability to dissolve a company when necessary is a right reserved in legitimate circumstances where there are no outstanding creditors, however, it can be open to abuse.

“The banking and finance industry therefore supports this legislation which will provide much needed powers to the Insolvency Service to help hold rogue directors to account by providing additional deterrents and easier enforcement of the rules.”

Did you miss our previous article…

https://www.drupalcamppa.org/?p=1673

Top Ten best read stories of 2021

The Enquirer is putting out its last daily newsletter of the year today as the industry winds-down for its traditional Christmas break.

The website will be updated with any major breaking stories during the holiday season with the full daily news service returning on January 4.

It has been an eventful 12 months and a busy news year for construction as the Enquirer keeps the industry up to date with what is really going on.

These were the best read stories during the year:

Our most popular stories in 2021

(Number of times they were read)

Mass brawl breaks out on London site – (65,706 page views)

Nmcn goes into administration – (53,228 page views)

Timber and steel shortages set to intensify – (46,462 page views)

Scaffold brought down on City of London site – (41,727 page views)

Six planned skyscrapers to change London city skyline– (41,340 page views)

Timber batten prices go through the roof – (35,604 page views)

Facebook site flooded by burst pipe– (31,793 page views)

Gove declares war on construction companies – (30,675 page views)

British Steel stops taking orders in face of ‘extreme’ demand – (30,558 page views)

National highways halts first smart motorway job– (30,015 page views)

The Enquirer enjoyed another year of growth as busy professionals turn to us for a fast and insightful news fix.

Our daily newsletter now has more than 49,000 subscribers.

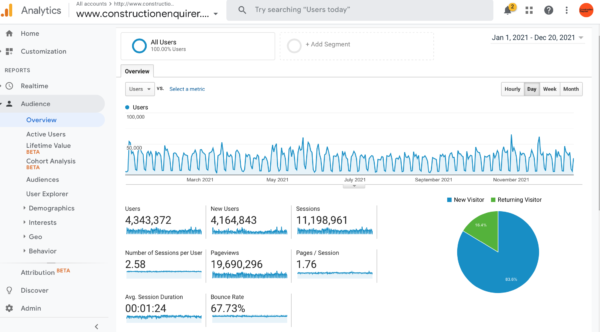

Google Analytics show the Enquirer enjoyed more than 19.6 million page views this year from more than 4.3 million users – numbers which dwarf any of our traditional construction media rivals.

Our growing band of advertisers enjoy industry leading response rates and all the details about booking a campaign for 2022 can be found here.

Display adverts were clicked on more than 120,000 times during the year generating a staggering 3,500 hours – or 145 days – viewing time of our advertisers’ websites by Enquirer readers.

Our recruitment pages are thriving thanks to our unrivaled reach into construction companies while our Suppliers and Buyers Directory has already signed-up more than 4,700 firms from across the supply chain.

We’d like to wish all our readers a very Merry Christmas and here’s to a happy New Year after a well deserved break.

Green light for major Bristol office scheme

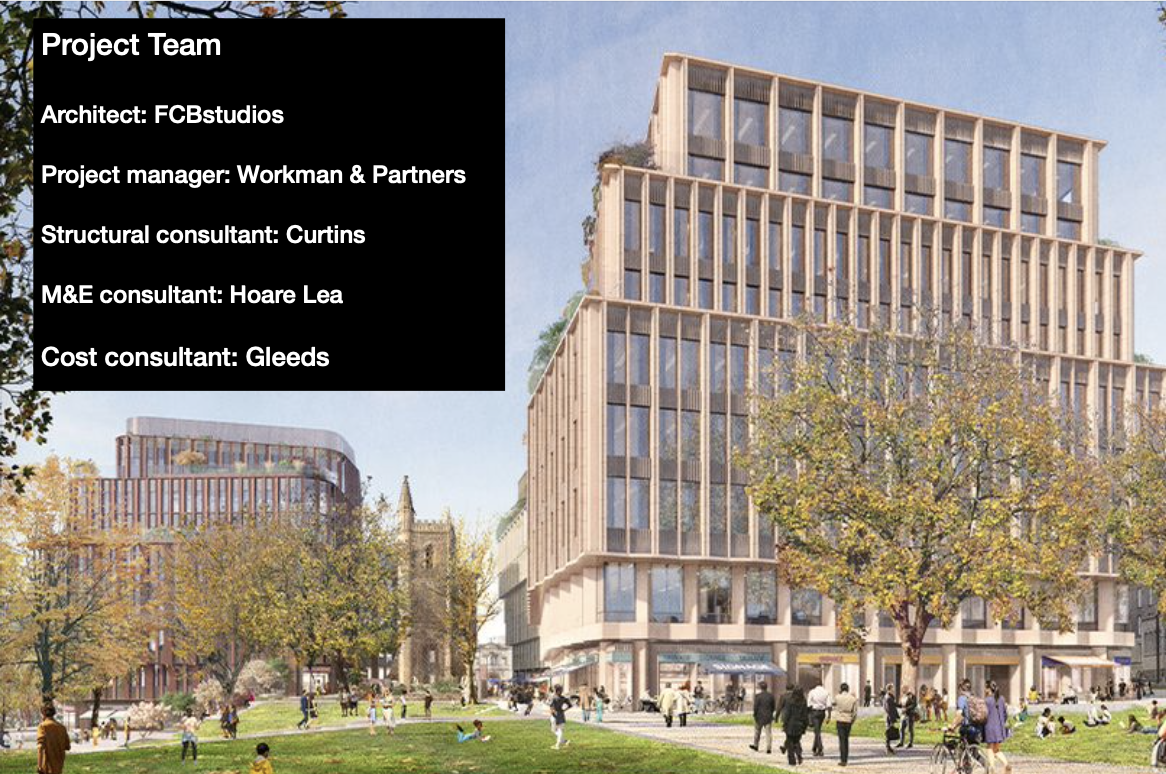

Plans for three new office blocks around a ruined church at the edge of Castle Park in Bristol have got the go-ahead from city planners.

Developer MEPC can now proceed with its plan to replace three former 1960s bank buildings at the corner of Wine Street and High Street with one nine-storey and two eight-storey office blocks, offering ground-level shops and cafes.

Under plans drawn up by architect FCBStudios, the ruined St Mary le Port church tower will be restored, and three historic city centre streets that were lost during the Blitz will be restored.

Roz Bird, commercial director at MEPC, said “After two years of detailed consultation with local stakeholders in the community, we are delighted that the Development Control Committee voted in favour of our application to rejuvenate the St Mary le Port site.”

An increase of 85% in biodiversity will be provided across the scheme, with an extensive planting scheme that will include over 70 new trees in and around the site, improvements to Castle Park itself and biodiverse terraces and green roofs.

Did you miss our previous article…

https://www.drupalcamppa.org/?p=1657

Southern Rail starts hunt for £3bn signalling and track partners

Network Rail’s southern region has alerted firms to a forthecomming bid race to find two partners for a new 10-year-plus deal to deliver signalling and track across the territory.

The region is hoping for step-change in the way renewals are delivered on its network, making the most of modern methods of working and technology, collaboration and relationship-focused contracting.

The fresh delivery approach known as the Southern Integrated Delivery model will involve a switch to integrated and collaborative Project 13 principals of delivery for an estimated work total work programme of up to £9.6bn over Control Periods 7 and 8.

This partnership approach will be used to deliver all categories of railway asset work including signalling & telecoms, track, buildings & civils, electrification and plant and minor works.

Building and civils is already out to tender with the search for separate signalling and track business partners on Kent Sussex and Wessex routes completing the shake-up.

Buildings and civils will account for 30% – 45% of spend, track 15% – 25%, signalling 5% – 15%, electrification and plant 5% -10% while minor works will constitute 20%- 30% of the overall estimated value.

Works programme

Lot 3: The Signalling Integrator Business Partner

• Early-stage development including all work types (renewals and refurbishment) typically GRIP 1 to 3

• Detailed design, construction and commissioning of all work types (GRIP 4 to 8) including targeted Interventions, Level Crossings and telecommunications associated with the signalling works, with the exception of major renewals

• Manage, coordinate and oversee the delivery for all appointed Eco-System OEM providers – who will be remitted to undertake major Signalling renewals

• Self-delivery of mid-size schemes/asset-life extension works.

Lot 4: Track business partner

Site investigation, survey, design, planning and installation of track works, including renewal, removal, refurbishment or new installation of plain line track, track drainage or switches and crossings by whatever means.

This includes re-alignment, lifting and lowering of track, 3rd Rail, remote condition monitoring, removal, replacement or new installation of lineside plant such as rail lubricators, fencing and rail crossings

Successful bidders will initially sign into a development phase agreement, scheduled to commence in January 2023 and run up until April 2024.

Following this, the partners will sign into a multi-party SID Agreement based on an Network Rail’s alliance form of contract.

Network Rail will host a virtual market briefing event on Thursday 20 January 2022, from 10.00 to 12:00 to brief interested firms.

To register for the event email the attendee’s name, organisation and contact number no later than 13 January. Title email “Southern Integrated Delivery (SID) – Market Briefing – Signalling & Track”.

Did you miss our previous article…

https://www.drupalcamppa.org/?p=1651

Plan submitted for 30-floor Salford resi tower

Manchester-based property developer CERT property has submitted plans for a 30-floor residential tower on Salford’s Clippers Quay.

The vertically zoned tower block, designed by OMI Architects, will offer a range of private living experiences from lower level affordable to top-floor luxury.

Local Manchester builder Domis Construction has been lined up for the project.

The lower brick-clad 9 floors will be set aside for co-living studios for people who want to try out the lifestyle available in the building with an affordable rental cost.

Above will be 15 floors of one and two-bedroom flats with high specification kitchens, bathrooms and all bills included.

In the top section of the building will be 15 luxury penthouse apartments with views Salford Quays and a top floor skybar.

In its consultation CERT said: “Successful urban areas such as Salford are seeing an influx of talented people from across the world.

“Cities have responded by delivering more city-centre residential accommodation, but these are often focused on the luxury areas of the market, meaning adults at the earlier stages of their career, or on lower incomes, may be forced to live in a less convenient and desirable location.

“Not with community living, our Clippers Quay development provides a variety of private living options for all.”

Project team

Did you miss our previous article…

https://www.drupalcamppa.org/?p=1648

Ameon lands £10m M&E package on twin Leeds towers

Building services specialist Ameon has landed a £10m mechanical and electrical contract from John Sisk & Son at Latitude Purple – the Hub Group’s twin-tower residential development in Leeds city centre.

Ameon will start on its 72-week phase of the contract next November and will deploy up to 80 operatives at peak on the projec.

Work will involve design and installation of the services infrastructure serving 463 residential apartments and communal areas in the 17 and 21-storey towers and the single-storey podium deck, linking the taller structures.

Ameon contracts director, Rod Bunce said: “We’ve demonstrated our capabilities on many high-rise residential tower blocks, particularly in the development hotspots of Manchester, Liverpool and Leeds in recent years; therefore I believe we’re a perfect fit for Latitude Purple, which will be a fantastic addition to the skyline of city centre Leeds.

“We’re also delighted to be working again with Sisk, with whom we have enjoyed excellent working relationships on previous projects and look forward to helping to bring Latitude Purple to life.”

Alan Rodger, Managing Director for UK North, John Sisk & Son, added: “I am delighted that we will be working with Ameon on this prestigious development for Hub Group, which will expand the city centre, and provide hundreds of quality homes for the local community.

“We have a brilliant working relationship with the company, forged on previous high-quality projects, and I am excited that we will get to strengthen that relationship further on Latitude Purple.”

To promote your latest contract package wins and your company products and services join the Enquirer Suppliers and Buyers directory here.

Did you miss our previous article…

https://www.drupalcamppa.org/?p=1645

Firms on notice for 20-year Suffolk highways upkeep deal

Suffolk County Council is calling up firms for market engagement feedback ahead of inviting bids for a long-term highways maintenance deal worth up to £1bn.

Kier currently holds the contract, which is a 10-year deal expiring at the end of September 2023.

The council is enticing contractors with the prospect of a long-term 20-year deal for the highways maintenance services, worth around £50m a year.

The initial contract length is anticipated to be 10 years from October 2023 to September 2033 with the option to extend for up to a further 10 years.

Suffolk council said that it recognised the challenges involved in delivering highways services as well as the many possible approaches, lessons learned and improvements that it wanted to adopt in developing its own strategy.

A key part of the procurement the council aims to embed social benefits and the council’s aim to be carbon net zero by 2030.

Interested parties should contact the council for a copy of pre-market engagementus questionaire ahead of the Project Launch Session and/or one-to-one discussions to be held on 27-28 January.

Did you miss our previous article…

https://www.drupalcamppa.org/?p=1638